Picture a chaotic household where money leaks like a runaway faucet, spilling into every corner and leaving a financial mess. Yet, amidst this disarray, there’s hope: a clear family plan tailored just for you. It’s more than numbers; it’s a path to a calmer, more secure life.

Unlocking the Power of Personal Budgeting

Understanding Your Income Streams and Expenses

Personal budgeting begins with a clear understanding of one’s financial landscape. This involves identifying all income streams, whether they come from a full-time job, freelance work, or passive income sources like investments. Every dollar counts. Detailing these sources is crucial because it forms the foundation of a budget.

But what about expenses? They can be sneaky. From the obvious, like rent and groceries, to the subtle, like that daily coffee run, expenses add up. Recognizing every outgoing penny is essential. It’s like trying to fill a bucket with a hole in it—without knowing where the leaks are, the bucket will never fill.

Setting Realistic and Achievable Financial Goals

Once the financial landscape is clear, it’s time to set goals. But not just any goals—realistic and achievable ones. Think of financial goals as a roadmap. Without them, one might wander aimlessly. Setting clear, specific targets for both the short and long term is key.

- Short-term goals: These could include saving for a vacation or paying off a small debt.

- Long-term goals: Consider saving for retirement or a child’s education.

Why is this important? Goals provide direction and motivation. They transform abstract desires into concrete plans. As Jane Doe, a financial advisor, wisely said,

“Successful budgeting starts with honesty about your spending habits.”

Being honest about one’s financial situation is the first step toward setting achievable goals.

Utilizing Digital Tools for Efficient Budgeting

In today’s digital age, technology can be a powerful ally in budgeting. Apps like YNAB (You Need A Budget) or Mint offer tools to track expenses and savings effortlessly. These tools can categorize spending, send alerts for due bills, and even suggest ways to save.

According to an ABC report, 60% of families use digital tools for budgeting. This statistic highlights a growing trend toward tech-savvy financial management. Why not join them? Leveraging these apps can make budgeting less of a chore and more of a habit.

Moreover, a survey by XYZ found that 75% of adults say they have a budget. This shows that many are already on the path to financial clarity. But having a budget is just the start. The real power lies in using it effectively, and digital tools can help achieve that.

In conclusion, the importance of understanding every dollar flowing into and out of one’s household cannot be overstated. Crafting a budget involves recognizing every revenue stream, setting clear goals, and utilizing available tools to stay on track. It’s not just about numbers; it’s about creating a roadmap to financial freedom.

Investing: Growing Your Family’s Future

Investing is more than just a financial strategy; it’s a way to secure your family’s future. But how does one start? What are the safe options? Let’s dive into the world of investments and explore how they can set your family on a path toward financial independence.

Exploring Safe Investment Options

When it comes to investing, safety is often a top priority. But what does “safe” mean in the investment world? It usually refers to options that offer lower risk and more predictable returns. Here are a few:

- Bonds: These are loans you give to a government or corporation. In return, they pay you interest over time. Bonds are generally considered safe because they offer fixed returns.

- Mutual Funds: These are collections of stocks and bonds managed by professionals. They offer diversification, which can reduce risk.

- Stocks: While riskier than bonds, investing in well-established companies can be a safe bet. Look for companies with a strong track record.

Choosing the right investment vehicle depends on your family’s financial goals and how much risk you’re willing to take. But remember, as John Smith wisely said,

“Investing is not a sprint, it’s a marathon for your future.”

Understanding Risk Tolerance and Diversification

Risk tolerance is your ability to handle the ups and downs of the market. It’s crucial to determine this before investing. How much can you afford to lose without losing sleep? This question is key.

Once you know your risk tolerance, diversification becomes your best friend. Why? Because it spreads your investments across different assets, reducing the impact of a poor-performing investment. Think of it as not putting all your eggs in one basket.

For instance, if you invest only in tech stocks and the tech market crashes, your portfolio suffers. But if you diversify with bonds, mutual funds, and stocks from various industries, you’re better protected. It’s like having a safety net.

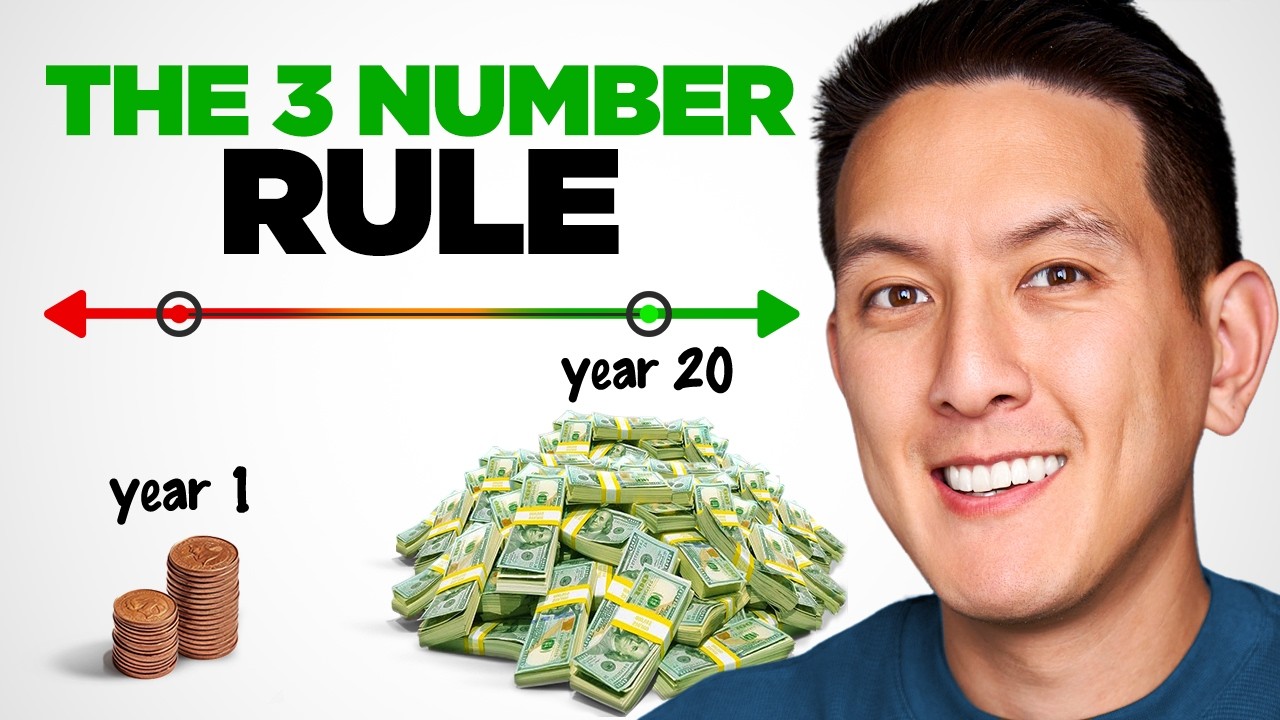

The Impact of Compound Interest Over Time

Compound interest is a powerful tool. It’s the process where the interest you earn on your investment also earns interest. Over time, this can significantly grow your wealth.

Consider this: with an average 7% annual return on conservative investments, your money can more than double in 30 years if reinvested. That’s over 200% growth! It’s like planting a tree and watching it grow into a forest.

Here’s a simple example: If you invest $10,000 today at a 7% annual return, in 30 years, you’d have over $76,000. That’s the magic of compounding!

Investments, when chosen wisely, can work for you over time. They can help you achieve financial independence and provide a secure future for your family. By exploring safe options, understanding your risk tolerance, and harnessing the power of compound interest, you’re setting a strong foundation for your family’s financial well-being.

Future Planning for Peace of Mind

Imagine waking up one day to find your car won’t start. Or perhaps, a sudden medical emergency arises. These unexpected events can throw anyone off balance. But, what if there was a way to cushion the blow? This is where the concept of an emergency fund comes into play. It’s not just a financial tool; it’s a safety net that offers peace of mind.

The Importance of Establishing an Emergency Fund

An emergency fund is like a financial umbrella on a rainy day. It shields you from the storm of unexpected expenses. Experts suggest that an emergency fund should cover three to six months of living expenses. This might sound daunting, but it’s achievable with consistent effort. Why is it so crucial? Because life is unpredictable. Without a safety net, even a small hiccup can lead to financial chaos.

Emily Davis, a renowned financial consultant, once said,

“Planning for unexpected events today secures your family’s tomorrow.”

This quote encapsulates the essence of future planning. It’s about being prepared, not just for yourself, but for your loved ones too.

Effective Strategies for Long-Term Savings

While an emergency fund is essential for short-term crises, long-term savings strategies are equally important. They are the building blocks of a secure future. But how does one go about it? Here are some effective strategies:

- Retirement Plans: Investing in retirement plans like 401(k)s or IRAs can ensure a comfortable life post-retirement. It’s never too early to start.

- Education Funds: Setting aside money for education can relieve future financial burdens. Consider options like 529 plans for college savings.

- Regular Savings: Consistently saving a portion of your income can accumulate over time, providing a substantial nest egg.

Did you know that only 40% of Americans have a long-term financial plan? This statistic highlights the need for more awareness and action in this area. Long-term savings are not just about money; they’re about security and freedom.

Teaching Financial Literacy to the Next Generation

Passing on financial wisdom to the next generation is crucial. It’s not just about teaching them to save money; it’s about instilling a mindset. How can this be achieved? Here are some ideas:

- Start Early: Introduce basic financial concepts to children. Use simple terms and real-life examples.

- Involve Them: Include teens in family budget discussions. Let them understand how money is managed.

- Encourage Saving: Motivate them to save for something they want. It teaches patience and the value of money.

By educating the younger generation, they become better equipped to handle their own finances. It’s an investment in their future.

Conclusion

In conclusion, future planning is not just a financial exercise; it’s a pathway to peace of mind. Establishing an emergency fund acts as a buffer against life’s uncertainties. Long-term savings strategies, like retirement and education funds, build a foundation for a secure future. Moreover, teaching financial literacy to the next generation ensures they are well-prepared to navigate their financial journeys.

By taking these steps, individuals can transform chaos into clarity, creating a financial plan that supports their household. Remember, the goal is not just to survive but to thrive. And with a solid plan in place, peace of mind is within reach.

TL;DR: Transform financial chaos into calm with a personalized household plan that combines budgeting, investing, and future planning for peace of mind.