Imagine sitting in your favorite cozy chair, a warm drink in hand, contemplating your legacy. The thought crosses your mind: ‘What will happen to my investments and assets when I’m gone?’ Not the most upbeat topic, I know! But if you take just two minutes, you can lay the groundwork for an effective estate plan that offers peace of mind for both you and your loved ones. In this post, we’ll break down how to get started quickly and efficiently.

Understanding Estate Planning: The Basics

Estate planning is a crucial process that everyone should consider. But what exactly is it? In simple terms, estate planning involves preparing for the distribution of one’s assets after death. It’s not just about who gets what; it’s about ensuring that your wishes are honored and your loved ones are taken care of. As Gregory L. Carter wisely stated,

“A solid estate plan can transform your financial legacy and provide security for loved ones.”

Why is Estate Planning Important?

Many people underestimate the importance of estate planning. However, it serves several vital purposes:

- Asset Distribution: It ensures that your belongings are distributed according to your wishes.

- Avoiding Probate: A well-structured estate plan can help your heirs avoid the lengthy and costly probate process.

- Minimizing Taxes: Proper planning can reduce the tax burden on your estate, allowing more of your wealth to be passed on to your beneficiaries.

- Reflecting Values: An estate plan can reflect your personal values and wishes, ensuring that your legacy aligns with what you hold dear.

Key Components of an Estate Plan

Creating an estate plan involves several key components. Understanding these can help individuals make informed decisions:

- Wills: A will is a legal document that outlines how your assets will be distributed after your death. It can also appoint guardians for minor children.

- Trusts: Trusts can be used to manage your assets during your lifetime and distribute them after your death. They can help avoid probate and provide privacy.

- Powers of Attorney: This document allows someone to make financial or medical decisions on your behalf if you become incapacitated.

Each of these components plays a significant role in ensuring that your estate is handled according to your wishes. But how do you know which components you need? This is where a financial advisor can help.

The Role of a Financial Advisor in Estate Planning

Many individuals may feel overwhelmed by the complexities of estate planning. A financial advisor can provide valuable guidance. They can help you:

- Assess Your Situation: A financial advisor can evaluate your financial situation and help you understand what your estate plan should include.

- Develop a Strategy: They can assist in creating a comprehensive strategy that meets your goals and ensures your wishes are honored.

- Navigate Legal Requirements: Estate planning involves various legal requirements. A financial advisor can help you understand these and ensure compliance.

- Review and Update: Life changes, such as marriage, divorce, or the birth of a child, may necessitate updates to your estate plan. A financial advisor can help you stay on top of these changes.

In essence, a financial advisor acts as a partner in the estate planning process. They provide personalized insight based on your unique situation, helping you make informed decisions.

Conclusion

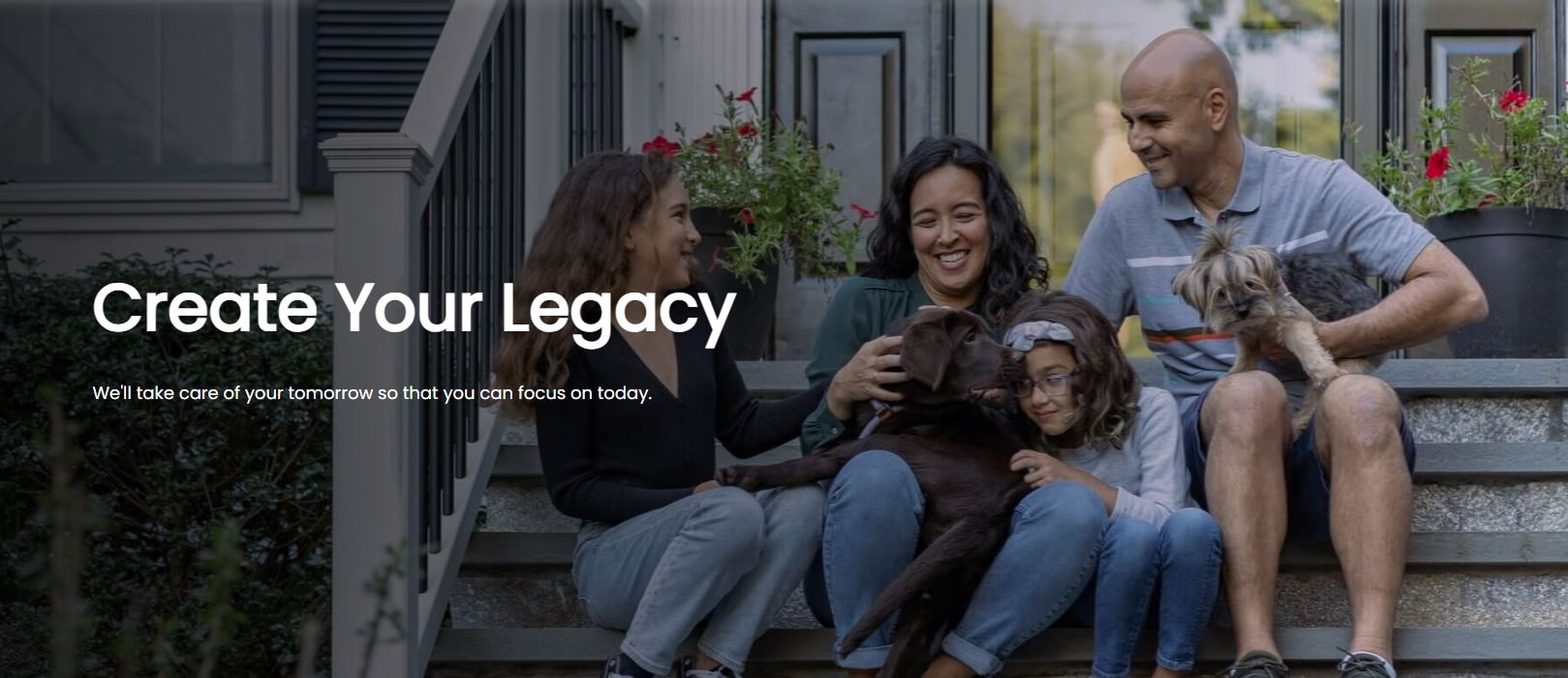

Estate planning is not just for the wealthy or the elderly. It is a fundamental process that everyone should consider, regardless of their financial situation. By understanding the key components of an estate plan and the role of a financial advisor, individuals can take proactive steps to protect their assets and ensure their wishes are honored. Remember, the goal is to create a plan that reflects your values and provides peace of mind for you and your loved ones.

Quick Steps to Create Your Estate Plan

Creating an estate plan can seem daunting. However, breaking it down into manageable steps makes the process easier. Here are some quick steps to guide anyone through the essentials of estate planning.

1. Identify Your Assets and Liabilities

The first step in crafting an estate plan is to identify your assets and liabilities. This includes everything you own, such as:

- Real estate

- Bank accounts

- Investments

- Personal property (cars, jewelry, etc.)

- Debts (mortgages, loans, credit card balances)

Why is this important? Assessing your assets gives clarity on what needs to be included in the plan. It helps in understanding the total value of your estate. This assessment also highlights any debts that need to be settled before distributing your assets.

2. Choose Beneficiaries Wisely

Next, it’s crucial to choose beneficiaries wisely. Beneficiaries are the individuals or entities who will receive your assets after your passing. They should be people you trust to manage your estate according to your wishes. Consider the following:

- Do they understand your values and desires?

- Are they capable of handling financial matters?

- Will they respect your wishes regarding your estate?

Choosing the right beneficiaries can prevent conflicts and ensure that your estate is handled as you intended. Remember, it’s not just about who gets what; it’s about ensuring your legacy is honored.

3. Consider Appointing Guardians for Minor Children

If you have minor children, appointing guardians is a crucial consideration. Who will take care of them if something happens to you? This decision can be emotional, but it’s necessary. Here are some points to ponder:

- Choose someone who shares your values and parenting style.

- Consider their ability to provide a stable environment.

- Discuss your wishes with them beforehand.

Guardianship is not just about who will raise your children; it’s about ensuring they grow up in a loving and supportive environment. This decision should be made with care and thoughtfulness.

Final Thoughts

As you navigate through these steps, remember that estate planning is not just about distributing assets. It’s about ensuring peace of mind for you and your loved ones. As a financial planning expert once said,

“Taking the first step in your estate planning is smarter than just procrastinating or hoping for the best.”

A quick assessment of your financial assets helps frame your estate plan. Additionally, choosing trustworthy beneficiaries who align with your wishes is imperative for a successful plan. By taking these steps, you can create a solid foundation for your estate plan, ensuring that your wishes are respected and your loved ones are cared for.

Common Missteps in Estate Planning

Estate planning is a crucial part of managing one’s assets and ensuring that wishes are honored after passing. However, many individuals make common mistakes that can lead to significant issues down the line. Understanding these missteps can help in creating a robust estate plan.

1. Neglecting to Update Your Estate Plan Regularly

One of the most frequent errors people make is neglecting to update their estate plan. Life is dynamic. Events like marriage, divorce, or the birth of a child can dramatically change one’s circumstances. These changes often necessitate updates to an estate plan.

Imagine having a will that still names an ex-spouse as the primary beneficiary. This scenario can lead to unintended consequences. Regular reviews of the estate plan ensure that it reflects current wishes and legal requirements. As Gregory L. Carter wisely stated,

“Your estate plan should be as dynamic as your life. Regular updates prevent common pitfalls.”

2. Overlooking Tax Implications of Your Estate

Another critical misstep is overlooking the tax implications of an estate. Tax laws are not static; they can change frequently. This means that what was once a sound strategy may no longer be effective. For instance, estate taxes can vary based on the total value of the estate and the current tax laws.

Failing to consider these implications can lead to a larger tax burden for heirs. It’s essential to consult with a tax professional or financial advisor to understand how changes in tax laws can affect estate planning strategies. This proactive approach can save families from unnecessary financial strain.

3. Not Communicating Your Wishes to Family Members

Communication is key in estate planning. Not discussing one’s wishes with family members can lead to confusion and conflict. When family members are unaware of the intentions behind an estate plan, it can create tension during an already difficult time.

Transparent conversations about estate plans can alleviate potential family disputes. It helps ensure that everyone understands the decisions made and the reasons behind them. This clarity can honor the legacy intended by the individual, making the process smoother for everyone involved.

Conclusion

In summary, effective estate planning requires regular updates, awareness of tax implications, and open communication with family members. Ignoring these aspects can lead to outdated plans, unexpected tax burdens, and family tensions. By being proactive and addressing these common missteps, individuals can create a more effective and respectful estate plan. This not only protects their assets but also honors their legacy as intended. After all, a well-thought-out estate plan is a gift to loved ones, providing them with clarity and peace during challenging times.

TL;DR: Creating an estate plan doesn’t have to be complex or time-consuming. A quick two-minute overview can set you on the path to protecting your assets and ensuring your wishes are honored after you pass. Get more information here.